Strong orders from both the enterprise and from the retail market meant growth in notebook sales during the month of November, largely due to HP’s position in the market.

Strong orders from both the enterprise and from the retail market meant growth in notebook sales during the month of November, largely due to HP’s position in the market.

That’s according to data from Digitimes Research which claims the top five multinational vendor and Taiwanese original design manufacturers (ODMs) showed shipments growing by 10 percent in the month, following a decline in shipments in October.

All the vendors are attempting to stem the growth of tablets and smartphones and the research outfit claimed HP ordered four million notebooks from its ODM partners in the month – with Quanta, Compal, and Investec benefiting from the push by the US giant.

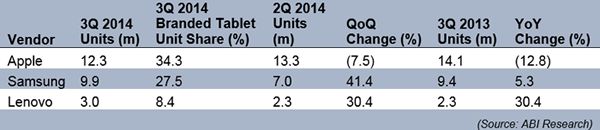

The researchers claim that shipments of global tablets will be in stasis for 2014, when all the figures are added up. And it also predicts sales will decline in 2015.

Digitimes Research estimates that combined shipments of notebooks and tablets will be over 350 million units in 2015 but the major vendors incuding Apple, Lenovo, Samsung, HP, Asustek, Dell and Acer will take steps to secure their positions in the marketplace.