Despite a miserable year for the smartphone industry, Lenovo managed to do rather well and saw its third quarter revenue rise 31 percent to $14.1 billion.

Despite a miserable year for the smartphone industry, Lenovo managed to do rather well and saw its third quarter revenue rise 31 percent to $14.1 billion.

This beat what the cocaine nose-jobs of Wall Street expected as its mobile division sales more than doubled following its acquisition of Motorola.

Lenovo wrote a cheque for $2.91 billion for Motorola, the US handset brand with a long sales history in the United States and Europe, as part of an effort to diversify away from the shrinking PC market.

These results took into account two months of Motorola’s performance and Lenovo said Motorola sold more than 10 million handsets during the quarter for the first time.

This is good news as Lenovo has been having trouble in its home market of China. Xiaomi swept aside Lenovo in China but has largely avoided Western markets due to fears of intellectual property challenges.

The company is expected to make a comeback against Xiaomi in China by adopting its rival’s Internet distribution model. Lenovo in May signed a deal with e-commerce site JD.com and announced a subsidiary last month to sell smartphones and wearables exclusively online.

Under Lenovo, Motorola will re-enter the Chinese market and be distributed primarily online, Yang said.

Total sales from the mobile division leapt 109 percent to $3.39 billion, or a quarter of the company’s sales.

Lenovo said net profit was $253 million, down from $265 million a year prior due to ballooning expenses associated with closing two major acquisitions. The Beijing-based company also acquired IBM’s low-end server unit for $2.1 billion.

The results beat expectations of $13.71 billion in revenue and $200 million in net profit.

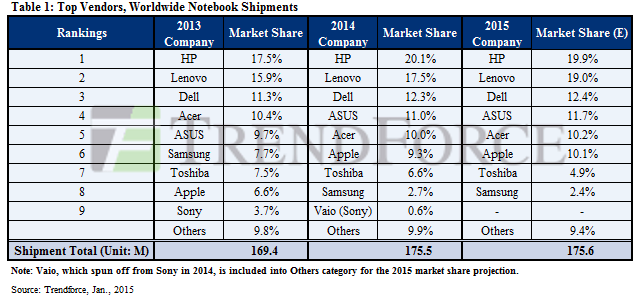

Lenovo continued to consolidate its hold on the PC market, reaching a record 20 percent share during the quarter with sales of $9.15 billion. Shipments rose five percent compared with a three percent decline in the broader industry, with growth particularly strong in Eastern Europe.

Apple continued to be the market leader for tablets in 2014 but it, in common with other vendors, showed a drop in sales.

Apple continued to be the market leader for tablets in 2014 but it, in common with other vendors, showed a drop in sales.