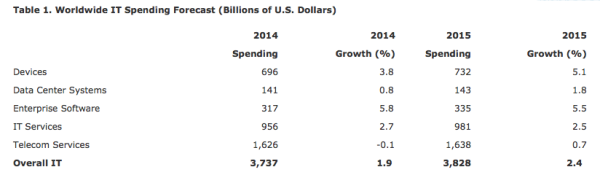

Analyst outfit Gartner is now predicting slow growth for IT spending this year.

Analyst outfit Gartner is now predicting slow growth for IT spending this year.

The firm has adjusted its 2019 global IT spending growth forecast to 1.1 percent, down from the 3.2 percent the research firm predicted back in January.

The reason appears to be economic factors such as a stronger US dollar; analysts now estimate that total IT spending will amount to £3.79 trillion – roughly the same as in 2018.

Gartner research vice president. John-David Lovelock said currency headwinds fuelled by the strengthening US dollar have caused Big G to revise its 2019 IT spending forecast down from the previous quarter

“Through the remainder of 2019, the U.S. dollar is expected to trend stronger, while enduring tremendous volatility due to uncertain economic and political environments and trade wars.”

Despite the slight overall growth, Garter said the data centre systems segment would suffer the most significant decline of 2.8 percent, as expected component cost adjustments continue to drive down average selling prices (ASPs) in the server market.

The ongoing enterprise shift from traditional, non-cloud to cloud-based setups, however, will continue to fuel enterprise software growth. In 2019, analysts predict the market to hit $427 billion, marking a 7.1 percent increase over 2018’s total of $399 billion.

While application software has so far seen the most extensive cloud shift, Gartner said it expects increased growth for the infrastructure software segment in the near-term – particularly in integration platform as a service (iPaaS) and application platform as a service (aPaaS).

“Disruptive emerging technologies, such as artificial intelligence (AI), will reshape business models as well as the economics of public and private sector enterprises. AI is having a major effect on IT spending, although its role is often misunderstood,” Lovelock commented.

“AI is not a product; it is a set of techniques or a computer engineering discipline. As such, AI is embedded in many existing products and services, as well as being central to new development efforts in every industry. Gartner’s AI business value forecast predicts that organisations will receive $1.9 trillion worth of benefit from the use of AI this year alone.”

IT spending won’t return to normal until 2022, claims according to analyst outfit Garter group.

IT spending won’t return to normal until 2022, claims according to analyst outfit Garter group.