Some call it the internet of things (IoT), some call it the internet of everything (IoE) and some even call it the internet of fangs (IoF).

Some call it the internet of things (IoT), some call it the internet of everything (IoE) and some even call it the internet of fangs (IoF).

Some call it the internet of things (IoT), some call it the internet of everything (IoE) and some even call it the internet of fangs (IoF).

Some call it the internet of things (IoT), some call it the internet of everything (IoE) and some even call it the internet of fangs (IoF).

According to a report from Cisco the latest buzzword on the world wide wibble, the Internet of Everything, will become a major market earner by the end of the year.

According to a report from Cisco the latest buzzword on the world wide wibble, the Internet of Everything, will become a major market earner by the end of the year.

The Internet of Everything is the networked connection of people, process, data and things so that “everything” joins the network.

Cloud computing is one of the early examples of the Internet of Things along with the boom in the mobility market.

According to the Internet of Everything Value Index study released by Cisco the global private-sector businesses to generate at least $613 billion this year.

Companies who optimise the connections among people, process, data and things will generate the largest profits, the report said.

Rob Lloyd, Cisco President of Development and Sales said that the study of 7,500 global business and IT leaders in 12 countries reports that the United States, China and Germany will earn the most.

They will be chasing the promise of nearly doubling their profits by adopting business practices, customer approaches and technologies that use Internet of Everything ideas.

He said that the Internet of Everything is already driving private-sector corporate profits, it is estimated that an additional $544 billion could be realised if companies adjusted their strategies.

“The Internet of Everything has the potential to significantly reshape our economy and transform key industries. The question is who will come out on top and win in this new economy. This study shows us that success won’t be based on geography or company size but on who can adapt fastest,” Lloyd said.

SmartThings CTO Jeff Hagins said that the study confirms the potential for the Internet of Everything.

“With the SmartThings platform and open community, we believe that more developers and inventors will be able to participate in the value chain and ultimately bring the physical graph to life,” he said.

Global businesses can pursue as much as $14.4 trillion over the next decade by using the Internet of Everything to improve operations and customer service.

Last week Cisco Worldwide Partner Summit in San Diego heard how the networking giant is planning to kill off its rivals in what it is calling a “brutal consolidation.”

Last week Cisco Worldwide Partner Summit in San Diego heard how the networking giant is planning to kill off its rivals in what it is calling a “brutal consolidation.”

The cunning plan is to eliminates the majority of the market incumbents in the next few years.

It was all blunt stuff. CEO John Chambers did not mince his words, and appeared to want to make mincemeat of anyone who dared to look at Cisco’s market share in a funny way.

“Far too often a competitor makes a statement and the market accepts it; but we have never lost a major battle in one of our core competencies,” he said. “Of our competitors from 15 to 20 years ago, none of them are here today. From 10 years only Juniper still exists, and we are going to get them.”

A few years ago Cisco was worried about HP, Huawei and Avaya but we have left them behind as well, he added.

Chambers is right, but at the same time Cisco has had a fair few problems of its own. It has had to do a fairly brutal restructuring of its own. The pain of the last few years certainly is not over.

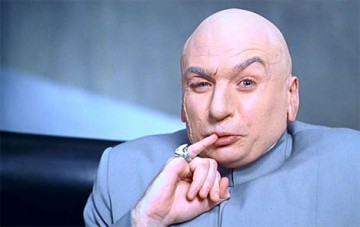

On top of that, Chambers has promised to remove three out of five of its rivals which is a fairly difficult task even for Captain Evil.

To the cheers of his minions, er partners, he said that there will be much consolidation and Cisco will end up on top.

Part of the success is because Cisco is providing most of the hardware for companies who have cloud and big data plans. The other is that it has been planning for something it calls the Internet of Everything for a while.

Chambers said that the internet of everything represents a $14.4tn sales over the next decade. If he is right then VARs in particular will have to change their approach to what they sell.

Instead of switches, routers and servers, they will be called upon to flog connected products. At the moment they are not really in this headspace.

At least they can understand cloud products and that data has to be supported and accessible. In the short term Cisco partners will probably be looking at Hosted Collaboration Solution and so-called smart services, more geared to analytics and monitoring.

Cisco is going to want to see a push around and Cisco’s monitoring and support services.

At the conference Cisco talked a lot about the future of services for partners. It had to in many ways. Much of its bold vision requires its channel partners to change their cunning plans. But the issue is that some of Cisco’s partners do not want to move into services and just want to keep selling hardware.

Senior vice president of Cisco Services Edzard Overbeek tried to wave a carrot at them. He pointed out that Cisco wrote more than $200 million in rebates to partners who generated more than $6 billion.

Overbeek thought the future of Ciscos channel lay in consulting services; platform services; and industry services.

Industry services, encompassing services created for specific vertical markets such as retail, finance or manufacturing, will be the most important, he predicted.

Whether its channel partners will sign up for that vision is still unknown.