Intel’s 730-series SSDs, which received glowing reviews, has been dogged by a rumour that it lacks power loss data protection, a feature which was highlighted in Intel’s review guides.

Intel’s 730-series SSDs, which received glowing reviews, has been dogged by a rumour that it lacks power loss data protection, a feature which was highlighted in Intel’s review guides.

The rumour was confirmed by Intel’s customer support department which made the mistake of implying that the SDD’s spec had changed.

The customer support person said that the SSD 730 was never built with the capacitor for the power loss data protection.

This means, the SSD does not have the capacitors at all, therefore the Intel’s website has the correct information of the drive.

Power data loss protection is a relatively important feature for anyone buying these drives and it puts reviewers such as Toms’ Hardware on the spot for not noticing it. The only problem is that when Toms’ reviewed the Intel 730 240GB SSD, it spotted it had two large capacitors on the PCB.

After all the fact that Intel included such technology on a mass-market drive was news.

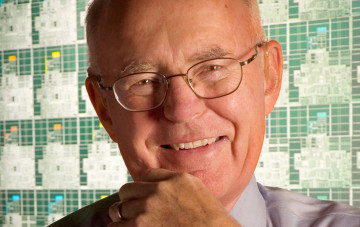

Intel moved to kill the rumours this week. Jeff Fick, Product Marketing Engineer on the Intel SSD 730 Series insisted that the Intel SSD 730 Series incorporates power loss protection circuitry, capacitors and firmware support to help protect user data.

He said that Intel customer support got it wrong. In fact it looks like contrary to Intel’s tech support’s statements, the capacitors do indeed exist and do provide a level of protection rarely seen on enthusiast-level SSDs.