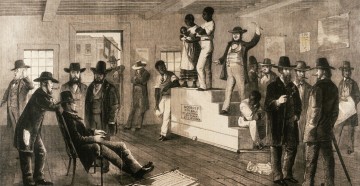

The proposed merger of Freescale and NXP will result in a semiconductor company that challenges the giants.

The proposed merger of Freescale and NXP will result in a semiconductor company that challenges the giants.

That’s according to chief analyst Dale Ford at IHS, who said the merged entity will be in the top 10 semiconductor companies in the world, outranking other giants such as Broadcom and ST Microelectronics.

He said the strength of uniting Freescale and NXP will be shown in automotive applications particularly.

NXP, formerly the semiconductor division of Dutch giant Philips, used to compete in the same market, said Ford.

But the new top 10 will look fundamentally different. By revenues, Intel will remain number one with 14.14 percent, followed by Samsung, Qualcomm, SK Hynix, US DRAM firm Micron, Texas Instruments and Toshiba.

The merged company will be second place in the micro controller market, and it will also have significant share in the digital signal processing (DSP) market, much used in consumer applications.

IHS noted in its report that Freescale is practically an exclusive source for power architecture processors – and although its share in this market is tiny compared to ARM and X86 semiconductors, it has big wins in the military aerospace market.