Big Blue said that it today introduced two flash enterprise storage products that give high performance and better reliability.

Big Blue said that it today introduced two flash enterprise storage products that give high performance and better reliability.

The products, called IBM Flash System storage come in two types, the V9000 and the 900.

The first of these allows enterprises to consolidate existing storage systems under a single management domain.

The 900 gives high performance, enterprise reliability and can be deployed in two hours, compared to days for conventional products.

IBM said it is committed developing flash based storage products to enterprises and industries of whatever size.

In April 2013, IBM invested a billion dollars in flash storage research, as well as making partnerships and product development.

It’s the larger amount of data that makes enterprises move to flash systems, according to Jamie Thomas, general manager of storage at IB.

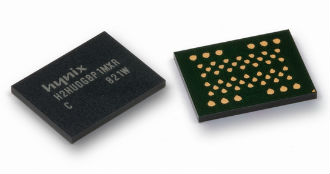

The systems use Micron semiconductors but IBM has hand tweaked the flash memory chips to deliver what it claims is a better sort of flash storage.