The online retail market in the UK is still going strong and according to IMRG Capgemini’s latest figures it is growing at the fastest rate in two years. IMRG Capgemini’s e-Retail Sales Index found that June sales rose 20 percent year-on-year. Furthermore monthly sales in June were better than in May for the first time in five years.

The online retail market in the UK is still going strong and according to IMRG Capgemini’s latest figures it is growing at the fastest rate in two years. IMRG Capgemini’s e-Retail Sales Index found that June sales rose 20 percent year-on-year. Furthermore monthly sales in June were better than in May for the first time in five years.

IMRG CIO Tina Spooner said the market has beaten expectations this year, with 16 percent growth in the first half of the year, beating the outfit’s earlier forecast of 12 percent. Mobile transactions are also doing well, up 136 percent year-on-year in June.

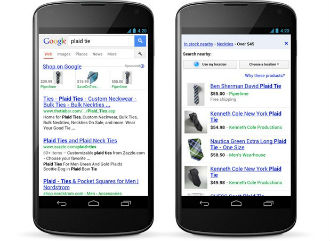

“Mobile commerce continues to power on in 2013. More specifically, the mobile conversion rate has increased from 1.27% in June 2012 to 2.03% in June 2013 which is a very positive signal that mobile commerce is achieving serious traction in the UK market,” said Oliver Ripley, mobile product manager at eCommera.

Ripley pointed out that modern retailers are investing more in mobile commerce storefronts, both through browsers and bespoke apps. The shopping experience is getting better for mobile users, with improved payment services and user interface improvements.

Ripley also noted that consumers are becoming more used to mobile transactions and this is especially true of younger consumers.

Chris Webster, VP, Head of Retail Consulting and Technology at Capgemini said the uplift experienced this month will provide retailers with a note of cheer.

“With the Index recording its biggest year-on-year growth since June 2011 and Q2 being 17% up on Q2 2012. This is in stark contrast to the continued decline in store footfall reported by the BRC over the first half of the year and amplifies the increase of online at the expense of store sales,” he said. “In addition, Britons remain price-conscious, but have responded well to good deals found online and it’s good to see consumer confidence returning.”