Worldwide server revenues grow by a third but while that is a good thing for vendors it is more due to supply shortages, according to analyst outfit Gartner group.

Worldwide server revenues grow by a third but while that is a good thing for vendors it is more due to supply shortages, according to analyst outfit Gartner group.

Apparently a shortage in components for server hardware, alongside currency fluctuations, has driven up the cost of servers in EMEA.

Worldwide server revenue increased 33.4 percent in the first quarter of the year and shipments grew 17.3 percent year over year.

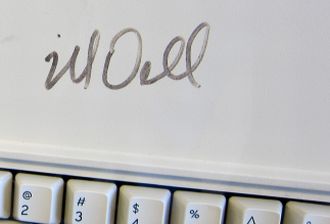

Adrian O’Connell, research director at Gartner, said the EMEA server market’s strong start to 2018 is largely driven by scarcity of materials increasing the cost of gear.

“The cost of certain components is increasing due to supply shortages, and this is compounded by recent currency volatility increasing the figures for revenue when measured in US dollars. The very modest rate of shipment growth demonstrates the effects of system pricing”, he said.

In EMEA, this caused revenue to grow by almost a third year-on-year to $3.7 billion for the quarter, while server shipments totalled just 517,000 units, an increase of only 2.7 percent year-on-year.

Analysts said that ongoing supply constraints in memory would continue into the second half of 2018, and that this is affecting the market and driving most revenue growth.

Dell EMC experienced a huge 51.4 percent revenue growth in the first quarter of 2018, widening the gap between it and second-placed HPE. Dell EMC recorded a 21.5 percent market share, followed closely by HPE with 19.9 percent of the market.

In EMEA, HPE maintained its primary spot, but it was third-placed Lenovo that had the strongest growth of 70 percent, Gartner said. This strong growth is partly due to comparison with a weak first quarter in 2017, as Lenovo’s business has been declining since the System X acquisition.

Dell EMC saw the second strongest growth rate of the top five vendors. “Dell EMC continues to perform well in EMEA”, said O’Connell. “The first quarter is usually a good quarter for Dell EMC, but it’s attained a record revenue share level in in the first quarter of 2018 and reduced the gap between itself and HPE to under 10 percent now.”

Gartner said the modest shipment growth rates suggest that market demand hasn’t increased much, and that ongoing memory supply constraints would continue into the second half of 2018.

“The very positive revenue performance, however, along with strong adoption at the start of this upgrade cycle, means it is at least a much more positive start to 2018 than we saw at the start of 2017”, said the report.

Dell is working with CrowdStrike and SecureWorks to offer enterprises access to endpoint security for digital transformation.

Dell is working with CrowdStrike and SecureWorks to offer enterprises access to endpoint security for digital transformation.