Fruity and nutty cargo-cult Apple has finally given up on servers and effectively ended its long history of poor networking technology.

Fruity and nutty cargo-cult Apple has finally given up on servers and effectively ended its long history of poor networking technology.

MacOS Server pre-dated Mac OS X by a year, launching initially in 1999. One of its main feature was Open Directory, which launched within Mac OS X Panther Server. It was a poor man’s version of Microsoft’s Active Directory and was designed to manage Macs, user accounts, and any settings on Mac-based networks.

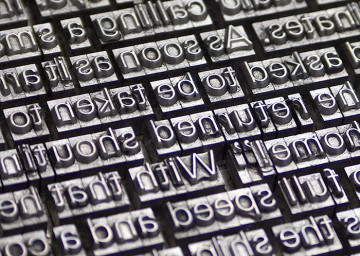

It was part of the life of publishers and newspapers which remained Mac based even when common sense suggested they would be better off with something that did not fall asleep on press day or slow to a crawl when a page needed saving.